1. What does “enough” mean for me?

One of the most common causes of financial stress isn’t a lack of money; it’s the absence of a clear definition of enough. Without it, the goalposts can keep moving. Comparison creeps in. More never quite feels like more. For some, enough means safety and peace of mind. For others, it’s freedom, flexibility, or choice. The challenge is that we often absorb other people’s definitions of success without realising it, whether that’s from society, peers, or what we think we should be aiming for.

I’ve found that defining “enough” isn’t a one-off exercise. It’s something I revisit to help keep financial decisions intentional rather than emotional. It doesn’t always go perfectly, but that regular check-in makes a real difference. When you’re clear on what enough looks like for you, money becomes a tool to support your life, not a constant source of pressure.

2. What am I hoping money will give me?

Behind every financial goal sits something deeper than the number itself.

Money is rarely just about money. More often, it represents:

- Peace of mind

- Independence

- Time

- Options

- A sense of security

When this isn’t explored, money can quietly become a stand-in for reassurance or acceptance, something we chase in the hope it will make us feel more settled or confident.

Asking this question shifts the focus away from accumulation and towards purpose. It helps reconnect financial decisions with the life they’re meant to support, rather than allowing money to become the goal in its own right.

3. How do my past experiences influence my relationship with money today?

None of us start from a blank slate. It’s more widely known that our relationship with money is formed by the time we are 7 years old. Our attitudes to money are shaped by what we saw growing up, early successes or mistakes, and periods of stability or uncertainty. These experiences leave a mark often influencing decisions without us even realising it.

Understanding this context matters. It helps explain why some financial choices feel emotional, why certain habits are hard to change, and why money can sometimes feel tied to guilt, fear, or pressure. Awareness doesn’t create instant answers, but it does remove judgement. And that’s often where meaningful, lasting change begins.

A final thought

There are no right or wrong answers to these questions. They evolve as life changes, priorities shift, and circumstances move on. But taking the time to ask them can transform how money feels from something that creates anxiety, to something that provides clarity, direction, and confidence. Financial planning is at its most effective when it starts with understanding, not just numbers.

Further reading

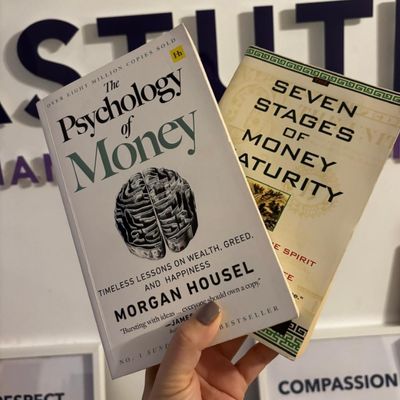

If you’re interested in exploring these ideas in more depth, two books that have strongly influenced this way of thinking are:

- The Psychology of Money by Morgan Housel

- The Seven Stages of Money Maturity by George Kinder

Both offer thoughtful, accessible perspectives on how money fits into real life beyond spreadsheets and performance charts.