How Compound Interest Works in Practice

If you put £1,000 (the principal) into an account earning 5 percent interest each year, after the first year you would have £1,050. In the following year, you earn 5 percent not just on the principal sum of £1,000 but also on the £50 interest from the first year, bringing your total to £1,102.50. Over time, this process of earning interest on both your savings and the interest they generate can significantly boost your overall growth.

Sometimes this is mistakenly referred to as “interest on interest,” but as shown above, it is interest earned on the principal plus any previously earned interest.

Simple Interest vs Compound Interest

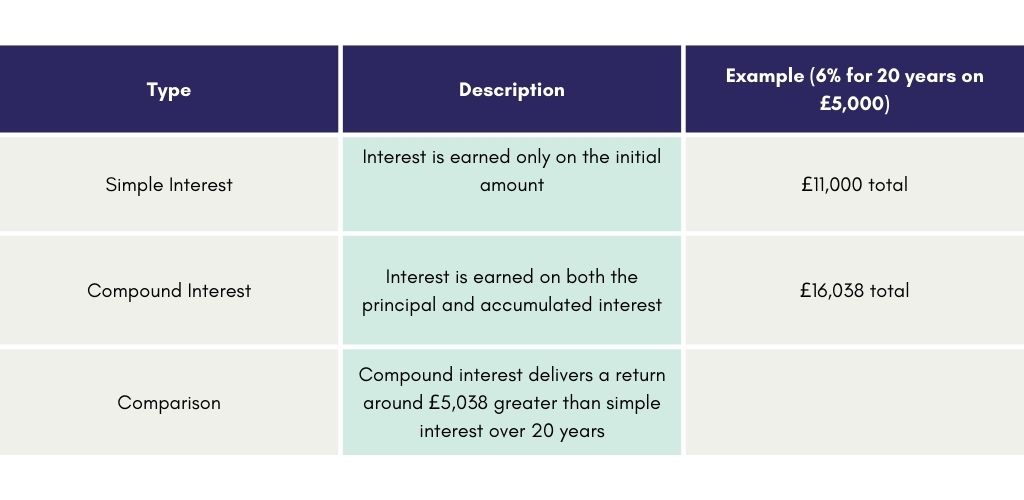

It is important to understand the difference between compound and simple interest, as this distinction can have a significant effect on your overall returns. We have already looked at what compound interest is, so what exactly is simple interest? Simple interest is calculated only on the original amount you invested or saved, not on any interest that has been added over time. This means your money grows at a steady, predictable rate, but it lacks the accelerating effect that compound interest provides. Over long periods, the difference between the two can become substantial, making compound interest far more powerful for building wealth.

Comparison

How to work out your return on investment

Here’s how I help my clients set goals that stick. You want to ensure that your gThe formula for compound interest is: A = P × (1 + r/n)^(n × t)

Where:

A = Final amount after t years

P = Principal amount (initial investment)

r = Annual interest rate (as a decimal)

n = Number of compounding periods per year

t = Number of years invested

If that sounds complicated, there is no need to worry. There are many free compounding calculators available, including one from trusted sources such as the Bank of England, which make it easy to see how your money could grow.

How Interest Rates Affect Your Investments

When investing, it’s important to consider whether the interest rate is fixed or variable, as this affects your projected returns. With a fixed rate, you know exactly what your return will be, whereas a variable rate can fluctuate, meaning you may not receive the amount you initially expected. It’s also important to review projections under both best-case and worst-case scenarios so you have a realistic understanding of potential outcomes. Examining historical trends and considering the broader macroeconomic environment can help create more accurate forecasts. A financial planner can assist in understanding the risks associated with different types of investments.

Keep in mind that the points above apply to cash investments like ISAs. Stocks and shares, while offering the potential for greater growth that can be reinvested to benefit from compounding, require a very different approach when forecasting returns.

Starting Early: The Key to Greater Financial Growth

The earlier you start and the longer you invest, the more your money will grow, bringing greater rewards over time.

Consider two savers:

- Clare starts investing £200/month at age 25, earning 6.5% annually.

- Tom starts at age 35 with the same £200/month and the same return.

At age 65:

- Clare’s balance = £459,198 (total saved £96,000, interest earned £363,198)

- Tom’s balance = £222,434 (total saved £72,000, interest earned £150,434)

Clare’s 10-year head start more than doubles her wealth, even though she invests the same amount each month. While she has contributed an extra £24,000 by starting earlier than Tom, she gains an additional £212,764 in interest.

Takeaway: Let Time Work for You

Compound interest is one of the simplest yet most powerful ways to build long-term wealth however it only works if you give it time to grow. The focus is not about finding the perfect investment or chasing the biggest short term returns. The real key is to start as early as possible and stay consistent. Every year you delay is a year of growth you miss out on so the sooner you start, the more financial freedom your money can provide in the future.

Disclaimer: If you’re investing in stocks and shares, remember that the value of your investments can go down as well as up, and you may get back less than you originally invested. With cash ISAs, your capital is protected, but the rate of growth can vary if you’re on a variable rate. A fixed-rate ISA, on the other hand, offers a guaranteed return over a set period.

At Astute Financial Planning, I provide forecasted returns based on a range of scenarios, along with personalised guidance to help you look to maximise your investments and stay on track toward your financial goals. Get in touch to find out how I can help you make your money work smarter.

Disclaimers:

Approver Quilter Financial Services Limited October 2025

Advice on cash held on deposit is not regulated by the Financial Conduct Authority

Sources:

Bank of England

Neither Astute Financial Planning nor Quilter Financial Planning are responsible for the accuracy of the information contained within the linked sites.